satix-web.ru Learn

Learn

Does Medicare Pay For Dentures Or Implants

If you have a condition that is deemed a medical necessity during your treatment, Medicare may be able to cover part of your dental implant treatment. You may. Medicare does not cover “dental issues.” It will not pay benefits towards anything tooth-related (such as fillings, extractions, dentures, etc.). Original Medicare (Parts A and B) does not cover dental implants. However, some Medicare Advantage plans (Part C) can offer help. Learn more at GoHealth. Dental coverage is optional in every state. In New York, the Medicaid program covers the cost of numerous dental procedures, including dentures and implants. Some MA plans cover general routine services, such as oral check-ups, cleanings, X-rays, and fillings, but some may help cover the costs of dental implants. While traditional Medicare does not cover most basic or prosthodontic care such as dental implants, some Medicare Advantage plans may provide help paying for. Depending on your specific needs, dental implants can range from $ to $25, As we age, dental problems can become more common. Tooth decay and loss can. As a rule, Medicare does not offer Dental insurance which would include Dental Implants. However there are options, and you should contact your insurance. The simple answer to 'does Medicare cover dental implants' is No, as Original Medicare does not cover dental care. However, some Medicare Advantage plans may. If you have a condition that is deemed a medical necessity during your treatment, Medicare may be able to cover part of your dental implant treatment. You may. Medicare does not cover “dental issues.” It will not pay benefits towards anything tooth-related (such as fillings, extractions, dentures, etc.). Original Medicare (Parts A and B) does not cover dental implants. However, some Medicare Advantage plans (Part C) can offer help. Learn more at GoHealth. Dental coverage is optional in every state. In New York, the Medicaid program covers the cost of numerous dental procedures, including dentures and implants. Some MA plans cover general routine services, such as oral check-ups, cleanings, X-rays, and fillings, but some may help cover the costs of dental implants. While traditional Medicare does not cover most basic or prosthodontic care such as dental implants, some Medicare Advantage plans may provide help paying for. Depending on your specific needs, dental implants can range from $ to $25, As we age, dental problems can become more common. Tooth decay and loss can. As a rule, Medicare does not offer Dental insurance which would include Dental Implants. However there are options, and you should contact your insurance. The simple answer to 'does Medicare cover dental implants' is No, as Original Medicare does not cover dental care. However, some Medicare Advantage plans may.

The implants are currently considered cosmetic no matter if you had to replace your whole face for necrotizing fasciitis. Unfortunately, Medicare does not cover Dental Implants. Many Medicare plans to not include Dental Insurance coverage. Dentures are covered under Medicare Advantage plans or Medicare Part C. Medicare Advantage plans are supplements to traditional Medicare plans. People insured by Medicare have to pay the full cost of cleanings, fillings, tooth extractions and dentures. Does Medicare cover dental implants? No, Original. People insured by Medicare have to pay the full cost of cleanings, fillings, tooth extractions and dentures. Does Medicare cover dental implants? No, Original. Medicare Advantage plan (Part C) is your only option for dental implant coverage. Original Medicare plans don't cover most dental services, even the basics. Medicare doesn't cover dental implants in Oklahoma (or any state). All isn't lost. There are options to help seniors pay for dental implants. The short answer is no. In general, dental care, including dental implants, is not covered by any Medicare plans. While Medicare will not directly cover most. Although Medicare typically doesn't cover routine dental care or procedures like dental implants, it may help pay for specific services related to dental. Medicaid may cover the cost of this treatment. However, it's unlikely that this kind of coverage will be provided as dental implants and other implant-. Medicare Advantage plan (Part C) is your only option for dental implant coverage. Original Medicare plans don't cover most dental services, even the basics. Original Medicare does not cover the cost of dental implants. However, those on a Medicare Advantage plan may find dental implant coverage built into their plan. While Original Medicare plans, Part A and Part B, do not cover routine dental care, nor do they cover dental implants, Medicare Advantage plans may cover. Does Medicare Cover Dental Implants? · Medicare is a federal health insurance program primarily designed for individuals aged 65 years or older and people with. Unfortunately, Medicare coverage also has no benefit for dental implants, so Medicare recipients would be faced with % of the cost if seeking implants as an. While traditional Medicare does not cover most basic or prosthodontic care such as dental implants, some Medicare Advantage plans may provide help paying for. Generally speaking, Medicare does not cover dental examinations and treatments such as dental implants. Still, in some cases, Medicare may contribute to the. Medicare will only cover dental work if it is deemed a medically necessary part of treatment you are required to have. What types of dental procedures aren't. Original Medicare does not cover dentures. Some Medicare Advantage plans, however, may offer the benefits you need. Learn more. Medicare and Medicaid do NOT pay for implants. And unless you have top of the line Advantage Plan (which is likely unaffordable to your dad.

Where Can I Get An Emergency Loan

FEEA's emergency hardship loan program provides no-fee, no-interest loans to federal employees facing personal emergencies. Learn more. Emergency Tuition Loan. The emergency loan will need to be repaid but is available for eligible students who do not have sufficient funds to complete their down. Emergency loans often offer flexibility, allowing you to use the money to address a variety of unexpected expenses. Lock in a fixed rate today. The best emergency loans have low interest rates, fast funding, and flexible terms. Check out our picks for the best emergency loans. Modest emergency loans are no big deal. Emergency loans in excess of 10 million indicate serious problems. US News selects the Best Loan Companies by evaluating affordability, borrower eligibility criteria and customer service. Any loan you can get on short notice to cover emergency expenses may be considered an emergency loan. However, some may come with more risk than others, with. FSA's Emergency loan program is there to help eligible farmers and ranchers rebuild and recover from sustained losses. You can get an emergency loan from any lender that provides personal loans. Some of the most common sources include banks, credit unions and online lenders. FEEA's emergency hardship loan program provides no-fee, no-interest loans to federal employees facing personal emergencies. Learn more. Emergency Tuition Loan. The emergency loan will need to be repaid but is available for eligible students who do not have sufficient funds to complete their down. Emergency loans often offer flexibility, allowing you to use the money to address a variety of unexpected expenses. Lock in a fixed rate today. The best emergency loans have low interest rates, fast funding, and flexible terms. Check out our picks for the best emergency loans. Modest emergency loans are no big deal. Emergency loans in excess of 10 million indicate serious problems. US News selects the Best Loan Companies by evaluating affordability, borrower eligibility criteria and customer service. Any loan you can get on short notice to cover emergency expenses may be considered an emergency loan. However, some may come with more risk than others, with. FSA's Emergency loan program is there to help eligible farmers and ranchers rebuild and recover from sustained losses. You can get an emergency loan from any lender that provides personal loans. Some of the most common sources include banks, credit unions and online lenders.

With good credit, you may qualify for an unsecured personal loan. Personal loans often have flexible uses for emergency situations. Personal loans are typically. A family emergency, loss of employment, natural disaster, or other unexpected issue can suddenly change your financial circumstances. Learn about short-term emergency loans available to students. UNC-Chapel Hill Emergency Loans are interest-free, short-term loans from the University to help enrolled students in need of temporary funds with emergency. Emergency loans can help you cover all kinds of emergency expenses. If you need cash ASAP, use Engine by MoneyLion to start your search. A trusted partner of. The Emergency Loan is a short-term, interest-free loan available to undergraduate students for up to $ and graduate students for up to $ per semester. The Missouri Department of Natural Resources provided no-interest loans to municipal utility entities for wholesale electric or natural gas costs incurred. Sometimes life hits you. Summit Credit Union has a loan to provide our NC members with quick cash. View our rates and apply for an Emergency Loan today. Need cash and can't wait for the weekend? Choose emergency loans! Get 24/7 online pre-approval for personal loans or title loans with Max Cash®. Best personal loans for emergencies · LightStream: Best for no fees. · LendingClub: Best for co-borrowers. · Upgrade: Best for small loans. · Avant: Best for fair. Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit. The Civic Emergency Loan offers qualified borrowers fast access to up to $ with an affordable fixed rate. It's a helping hand when you need it most. If you are a University of California employee you are eligible for an emergency loan from University Credit Union. Become a member and apply today! Guidelines · Employees of Hamline University are not eligible for an emergency loan · No emergency loans will be issued to pay Hamline University-sponsored. Loan Uses. Emergency loan funds may be used to: • Restore or replace essential property;. • Pay all or part of production costs associated with the disaster. A smart alternative to costly payday loans or more expensive credit card debt, our emergency loans allow you to borrow from $ to $5,, with no collateral. Emergency business loans can save the day when you need quick access to working capital. No matter how big or small a disaster you've experienced, an. Emergency Loans are short-term loans that must be repaid by the scheduled due date(s). Loan Types: Student is responsible for % of tuition and fees. I've been trying to get pay day loan or an emergency loan to survive for a little bit, but after 3 days of applying, I got declined and declined and declined. To get an emergency loan, you will choose a lender and typically go through an online application process.

Car Finance Rate Based On Credit Score

Score cutoffs for credit are - - - - - - and above. Each level will get you a 1/8 to a 1/4 better rate. Unless you. Explore North Shore Bank's interest rates for car, truck, and SUV loans rate based on borrower credit score, loan amount, vehicle age and condition. Calculate an auto loan by your credit score. Auto consumer calculator. View the APR for your FICO. View maximum loan, term, and monthly payment. When you get an auto loan, your interest rate depends largely on your credit score, a number between and on the FICO credit scoring model (it's the most. One of the ways this will impact your auto loan is the interest rate you will qualify for. Interest rates can range from % for those with excellent credit to. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! Average Auto Loan Rates by Credit Score ; Deep subprime, , % ; Subprime, , % ; Near prime, , % ; Prime, , %. Buyers with high credit scores usually get the most attractive interest rate offers on a car loan. Shopping for loans from different lenders takes time but it. Car loan rates by credit score. When you apply for a car loan, auto dealers This score is based on the original FICO score model used to generate your credit. Score cutoffs for credit are - - - - - - and above. Each level will get you a 1/8 to a 1/4 better rate. Unless you. Explore North Shore Bank's interest rates for car, truck, and SUV loans rate based on borrower credit score, loan amount, vehicle age and condition. Calculate an auto loan by your credit score. Auto consumer calculator. View the APR for your FICO. View maximum loan, term, and monthly payment. When you get an auto loan, your interest rate depends largely on your credit score, a number between and on the FICO credit scoring model (it's the most. One of the ways this will impact your auto loan is the interest rate you will qualify for. Interest rates can range from % for those with excellent credit to. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! Average Auto Loan Rates by Credit Score ; Deep subprime, , % ; Subprime, , % ; Near prime, , % ; Prime, , %. Buyers with high credit scores usually get the most attractive interest rate offers on a car loan. Shopping for loans from different lenders takes time but it. Car loan rates by credit score. When you apply for a car loan, auto dealers This score is based on the original FICO score model used to generate your credit.

This number determines what your car loan interest rate will be, and will also determine your eligibility for loans. So what what exactly is a credit score and. Calculate what your payments will be when financing a vehicle Many factors affect your FICO Scores and the interest rates you may receive. New and Used Car Loan Interest Rate by Credit Score ; , %, ; , %, ; , %, ; , %, Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in. Car Loan APRs by Credit Score. As of , the average interest rate for car loans was percent for new cars and percent for used cars. However, these. To calculate interest rates on car loans, we look at a few financial factors and the vehicle you are considering buying. Credit score—Generally, you can get a. For a three-year car loan, % is the average auto loan interest rate. Keep in mind that your credit score as well as where you're getting the loan can affect. Otherwise, you can use the current average interest rate for your credit score. This table uses Experian average car loan APRs by credit score (based on the. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! Average interest rates for car loans ; , , , ; New-car loan, %, %, %, %. Lenders use this score to determine the interest rate, terms and approval of auto loan applications. A higher FICO Auto Score tells the lender you're a lower. Borrowers with favorable credit scores — or higher — generally qualify for auto loans with the most attractive terms. · If your credit score is on the lower. As you can see from the above numbers, the best rates for an auto loan can vary significantly, depending on your credit score. (For example, anywhere from. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. Rates as of Aug 21, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. New/Used Auto financing available up to % Loan to Value ; %, %, %, % ; %, %, %, %. Determining your APR will likely depend on your credit score, national rates, and other industry factors. You could get pre-qualified for a loan and receive an. The finance manager tells you that your rate is based on your credit score of “WHAT”, you say! The fact is, the “free” score you obtained from Credit. As you can see from the above numbers, the best rates for an auto loan can vary significantly, depending on your credit score. (For example, anywhere from.

Can You Lose Too Much Weight On Keto

8 ways you could be doing keto wrong · 1. Eating too many carbs. The main reason why many people find that they are not losing weight with keto is that they are. Recent studies have revealed that intermittent fasting can lead to the loss of lean muscle mass – a concern for some who follow the popular dieting method. Once you get into the state of Ketosis, most people will lose an average of pounds a week. But in experience, people often report losing. If you do choose to follow any of the above keto diet types, the likelihood is you are doing it to lose fat. Although many people do a ketogenic diet for. A very low-calorie diet equals weight loss — sometimes in a short amount of time. But when weight comes off quickly, it can go back on quickly. Realize that. In fact, almost any diet that helps you shed excess weight can reduce or even reverse risk factors for heart disease and diabetes. And most weight-loss diets —. “Rapid, significant weight loss [at the beginning of the diet] is a common side effect of the keto diet because of the water losses that occur as carbohydrate. Research has shown a ketogenic diet can induce rapid weight loss, partly from water loss but also some fat loss. Berg On Belly Fat. Dr. Eric Berg DC•M views · · Go to channel · Will KETO Cause Too Much Weight LOSS? KenDBerryMD•62K views · · Go. 8 ways you could be doing keto wrong · 1. Eating too many carbs. The main reason why many people find that they are not losing weight with keto is that they are. Recent studies have revealed that intermittent fasting can lead to the loss of lean muscle mass – a concern for some who follow the popular dieting method. Once you get into the state of Ketosis, most people will lose an average of pounds a week. But in experience, people often report losing. If you do choose to follow any of the above keto diet types, the likelihood is you are doing it to lose fat. Although many people do a ketogenic diet for. A very low-calorie diet equals weight loss — sometimes in a short amount of time. But when weight comes off quickly, it can go back on quickly. Realize that. In fact, almost any diet that helps you shed excess weight can reduce or even reverse risk factors for heart disease and diabetes. And most weight-loss diets —. “Rapid, significant weight loss [at the beginning of the diet] is a common side effect of the keto diet because of the water losses that occur as carbohydrate. Research has shown a ketogenic diet can induce rapid weight loss, partly from water loss but also some fat loss. Berg On Belly Fat. Dr. Eric Berg DC•M views · · Go to channel · Will KETO Cause Too Much Weight LOSS? KenDBerryMD•62K views · · Go.

Consuming Too Many Carbs. We all know that carbohydrate intake must be drastically reduced in order to induce ketosis, but the number of carbs required will. To lose weight, you need to consume fewer calories than you expend. You can still eat too many calories on a keto diet. Many keto-friendly foods are high in. Many studies have demonstrated the powerful weight loss effects of a keto, diet. However, this diet can be challenging to maintain and may cause health problems. Don't worry, your baby will get all the necessary calories and nutrients they need at this point. Fat reserves. Overweight women have an extra reserve of. Berg On Belly Fat. Dr. Eric Berg DC•M views · · Go to channel · Will KETO Cause Too Much Weight LOSS? KenDBerryMD•62K views · · Go. It can be, but minimizing carbs isn't a guaranteed formula for shedding pounds. If you want to promote sustainable fat loss, there are many factors to consider. weight loss with low-carb diets. Some studies show that you may shed some weight because the extra protein and fat helps you feel full longer. Feeling full. While individual results of the diet can vary widely in different people, most people will see a rise in their cholesterol level, even if they lose weight. While the keto diet appears to lead to quick weight loss in the short term, critics say that much of that is water weight and point out that long-term research. The ketogenic way of eating is a very powerful way to lose fat. Thousands of people have lost millions of pounds using keto strategies. [*] That's pounds of pure fat per week. Another study found that obese patients weighing kg dropped 10 kg (22 pounds) after 8 weeks. They lost an extra. Low-carb diets and rapid weight loss. Glycogen tends to hold onto water. So if you don't have a lot of glycogen, you're not retaining water. In the. Ken D Berry, MD Nov 3, Will KETO make you lose TOO MUCH weight? WATCH➡️ satix-web.ru It can be, but minimizing carbs isn't a guaranteed formula for shedding pounds. If you want to promote sustainable fat loss, there are many factors to consider. Note that as you get closer to reaching your ideal weight, the rate of weight loss will most likely slow down. It's normal to reach a temporary plateau at some. Too much fat If you're not eating the right amount of fat, it may be preventing your body from relying on its own body fat for energy; thus, weight loss. With limited research into the keto diet for weight loss, and few long-term studies, we wouldn't recommend it. There are other diets that limit carbs, but not. This loss of excess water is what causes the sudden and dramatic weight loss in the first week of going Keto. Although this is not fat loss, it does mark the. Ketosis symptoms · Rapid weight loss. · Loss of appetite. · Bad breath, also known as keto breath. · The “keto flu,” which can include headache and brain fog.

Federal Reserve Cryptocurrency

The Reserve Bank is actively researching central bank digital currency (CBDC) Ethereum-based DLT platform. Project Atom report KB. Project Dunbar. Cryptocurrency · Cybersecurity · Internet & Telecommunications · Media The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. After all, money in the United States was booked and transferred digitally long before the advent of cryptocurrencies. Commercial bank reserve balances at the. EP: Let's say all American citizens had, in effect, an account with the Federal Reserve, then it would be a lot easier for the Fed to undertake certain. The federal banking agencies, the Consumer Financial Protection Bureau, an independent agency of the Federal Reserve Board established under the Dodd-Frank Act. Federal Reserve and digital balances held by commercial banks at the Federal Reserve. CBDCs are similar to stablecoin -- a type of cryptocurrency that. Explore resources provided by the Research Division at the Federal Reserve Bank of St. Louis. About FRED; What is FRED · Tutorials · Data Literacy · Contact Us. Arthur Hayes connects Federal Reserve actions to a short-lived economic boost with ripple effects on Bitcoin and broader crypto markets, underscoring risks from. Another type of cryptocurrency are stablecoins, whose value is pegged to an The Fed is falling behind as other central banks leap ahead on digital currencies. The Reserve Bank is actively researching central bank digital currency (CBDC) Ethereum-based DLT platform. Project Atom report KB. Project Dunbar. Cryptocurrency · Cybersecurity · Internet & Telecommunications · Media The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. After all, money in the United States was booked and transferred digitally long before the advent of cryptocurrencies. Commercial bank reserve balances at the. EP: Let's say all American citizens had, in effect, an account with the Federal Reserve, then it would be a lot easier for the Fed to undertake certain. The federal banking agencies, the Consumer Financial Protection Bureau, an independent agency of the Federal Reserve Board established under the Dodd-Frank Act. Federal Reserve and digital balances held by commercial banks at the Federal Reserve. CBDCs are similar to stablecoin -- a type of cryptocurrency that. Explore resources provided by the Research Division at the Federal Reserve Bank of St. Louis. About FRED; What is FRED · Tutorials · Data Literacy · Contact Us. Arthur Hayes connects Federal Reserve actions to a short-lived economic boost with ripple effects on Bitcoin and broader crypto markets, underscoring risks from. Another type of cryptocurrency are stablecoins, whose value is pegged to an The Fed is falling behind as other central banks leap ahead on digital currencies.

Cryptocurrency · Cybersecurity · Internet & Telecommunications · Media Federal Reserve Board of Governors, said in April In that same month. The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its Federal Reserve Bank Seal. Cryptocurrency · Futures & Commodities · Bonds · Funds & ETFs · Business · Economy Federal Reserve. Economy · World Economy · US Economy · The Fed · Central. Federal Reserve Gov. Christopher Waller says the central bank is tracking research on financial stability risks related to payments, as. Federal Reserve Chair Powell Holds His News Conference. Chip Somodevilla/Getty Images. 7 min read Published July 31, Written by. James Royal, Ph.D. Audio: This makes it different from cryptocurrencies that are issued by private firms and not as stable. Visual: A circle with a bitcoin symbol transitions. The official Twitter channel of the Board of Governors of the Federal Reserve System. Privacy Policy: satix-web.ru Federal Reserve Bank of Boston. The goal of Project Hamilton is to With the rise of digital payments, cryptocurrency, and various payment. Cryptocurrency · Futures & Commodities · Bonds · Funds & ETFs · Business · Economy Federal Reserve. Economy · World Economy · US Economy · The Fed · Central. The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows eligible depository institutions of different sizes. The ECB and the Federal Reserve have proposed intermediated CBDCs. Alternatively, the central bank could either provide the full service or delegate. Federal Reserve master accounts or the payments system. Special purpose bank charters or similar alternatives should not be granted to crypto entities that. The bond purchases are slated to end in early March Why does the Fed buy long-term debt securities? Quantitative easing helps the economy by reducing long. Fed can best support educators' efforts. Image. Evening at the Fed featuring Jessie Maniff presenting her talk on cryptocurrency. Image. Chad Wilkerson. Federal Reserve Bank of Boston. The goal of Project Hamilton is to With the rise of digital payments, cryptocurrency, and various payment. According to the IC3, $ billion of that came from cryptocurrency fraud. Crypto-related fraud experienced a 53 percent increase from to With. Issued by the Reserve Bank of India (RBI), it is a legal tender exchangeable at par with the existing paper currency. It is distributed in the form digital. What is a central bank digital currency? In an effort to assert sovereignty, many central banks, including the U.S. Federal Reserve, are considering introducing. Official International Reserves · Credit conditions · Staff economic projections. These forecasts are provided to Governing Council in preparation for monetary.

Best Small Car For Ladies

Explore the Ford Small Cars range, including the New Puma sporty crossover, New EcoSport small SUV and the New Fiesta. See more about Ford small cars here. Here we've picked out some of the best used small cars, from city-aimed options to more practical models and even EVs. Best Compact Cars · Honda Civic / Civic Hybrid · Toyota Prius · Toyota Prius Prime · Mazda 3 · Volkswagen Jetta · Hyundai Elantra. Your guide to buying the best small car in Australia. Read expert real-word reviews and advice to help you decide which small car is best for you. Corolla is the best choice and I'd strongly recommend the Hybrid. Hybrid pays for itself in about 3 years. For women who are interested in Hatchback cars, some of best models are Toyota Yaris at RM RM 88, - RM 99,, Honda City Hatchback at RM RM 85, - RM. What are the top 3 vehicles among best compact cars? The Honda Civic, Hyundai Elantra, and Toyota Corolla are the highest-rated models on KBB. Here are 10 highly-popular used car choices you can come and try out today at one of our showrooms. 1. Ford Fiesta. Here are the best small cars you can buy in Bore off SUVs, these brilliant little cars are the perfect antidote. Explore the Ford Small Cars range, including the New Puma sporty crossover, New EcoSport small SUV and the New Fiesta. See more about Ford small cars here. Here we've picked out some of the best used small cars, from city-aimed options to more practical models and even EVs. Best Compact Cars · Honda Civic / Civic Hybrid · Toyota Prius · Toyota Prius Prime · Mazda 3 · Volkswagen Jetta · Hyundai Elantra. Your guide to buying the best small car in Australia. Read expert real-word reviews and advice to help you decide which small car is best for you. Corolla is the best choice and I'd strongly recommend the Hybrid. Hybrid pays for itself in about 3 years. For women who are interested in Hatchback cars, some of best models are Toyota Yaris at RM RM 88, - RM 99,, Honda City Hatchback at RM RM 85, - RM. What are the top 3 vehicles among best compact cars? The Honda Civic, Hyundai Elantra, and Toyota Corolla are the highest-rated models on KBB. Here are 10 highly-popular used car choices you can come and try out today at one of our showrooms. 1. Ford Fiesta. Here are the best small cars you can buy in Bore off SUVs, these brilliant little cars are the perfect antidote.

Our list of the best small automatic cars includes traditional 'torque converter' automatics, dual-clutch automatics and CVT automatics. The small car categories for Drive Car of the Year have something for buyers on any budget, with all winners delivering the best big car qualities in. These aren't just the best small cars, they're some of the best new cars you can buy in the UK, full stop. Affordable, cheap to run and packed with the sort of. Best Small Cars for 20· Honda Civic Type R · Volkswagen GTI · BMW M2 · Hyundai Elantra N · Audi S4 · Honda Civic. What are the top 3 vehicles among best compact cars? The Honda Civic, Hyundai Elantra, and Toyota Corolla are the highest-rated models on KBB. What are the top 3 vehicles among best compact cars? The Honda Civic, Hyundai Elantra, and Toyota Corolla are the highest-rated models on KBB. Table of Contents · Best Small Car for Women: Tata Tiago · Best Family Car For Women: Maruti Baleno · Best Off-Road Car for Women: Mahindra Thar · Best Large Family. Welcome to the official site for MINI USA. Find authorized dealer information and browse our latest models, specs, features, and offers at satix-web.ru Why a small car is the ideal choice · Easy to handle · Remarkably roomy · Less to clean, more room in the garage · Safety first · Smaller footprint · More affordable. Explore the Ford Small Cars range, including the New Puma sporty crossover, New EcoSport small SUV and the New Fiesta. See more about Ford small cars here. Table of Contents · Best Small Car for Women: Tata Tiago · Best Family Car For Women: Maruti Baleno · Best Off-Road Car for Women: Mahindra Thar · Best Large Family. Visit our website to find everything you need to know about small cars: from deciding which small car is right for you to selecting the best offer. Despite the prominence of SUVs and utes, small cars are very popular in NZ. We look at why and recommend 5 of the best. Deals · Small car deals · Ford Fiesta · Hyundai i10 · Kia Picanto · Renault Clio · Seat Mii · Toyota Yaris · Volkswagen Polo. Volkswagen up! Even though they're the most affordable luxury cars, extra-small luxury sedans offer many of the same amenities as their larger siblings, though evidence of. Nissan Leaf After years on the market, the Nissan Leaf has held its own as one of the best small electric car options. With some great safety tech including. Deals · Small car deals · Ford Fiesta · Hyundai i10 · Kia Picanto · Renault Clio · Seat Mii · Toyota Yaris · Volkswagen Polo. Volkswagen up! Small sedans like the Honda Civic and Toyota Corolla remain some of the best ways to stretch your dollars, but electric cars like the Tesla Model 3 as well as. Popular Small Cars · Honri Ve; PKR - lacs · Suzuki Alto; PKR - lacs · Suzuki Cultus; PKR - lacs · Suzuki Wagon R; PKR - Despite the prominence of SUVs and utes, small cars are very popular in NZ. We look at why and recommend 5 of the best.

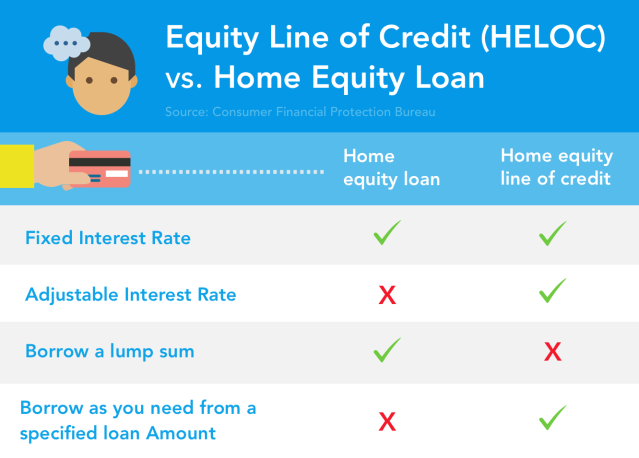

Low Cost Home Equity Line Of Credit

Fixed-rate loan · Our home equity loan rate is as low as % APR.* · Up to a year repayment period · Borrow up to 95% of your home's value (minus the amount. A KeyPoint Home Equity Line of Credit (HELOC) gives you access to the money you need at a low rate, with no annual or early termination fees. Get your personalized rate for a Home Equity Line of Credit up to $K with Citizens FastLine, the simpler, faster way to get a HELOC. Low-cost disability and credit life insurance are available; Our friendly Home Equity Line of Credit. Get approved for a loan that you can tap into. Come in · Low, fixed rates · Keeps your first mortgage in place · Possible tax deductions · Up to 90% loan-to-value for qualified borrowers · Competitive rates · No. A Home Equity Line of Credit (HELOC) lets you access money as you need it—now and in the future. Apply Online Let Us Contact You. Low cost. Because HELOCs are secured, they typically have lower rates than personal loans or credit cards. In addition, there are no application fees or. Additional HELOC Benefits ; Enjoy financial flexibility. · Rates may often be lower than other forms of borrowing like credit cards or personal loans ; Lock in a. Home Equity Lines of Credit (HELOC) are variable-rate lines. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are. Fixed-rate loan · Our home equity loan rate is as low as % APR.* · Up to a year repayment period · Borrow up to 95% of your home's value (minus the amount. A KeyPoint Home Equity Line of Credit (HELOC) gives you access to the money you need at a low rate, with no annual or early termination fees. Get your personalized rate for a Home Equity Line of Credit up to $K with Citizens FastLine, the simpler, faster way to get a HELOC. Low-cost disability and credit life insurance are available; Our friendly Home Equity Line of Credit. Get approved for a loan that you can tap into. Come in · Low, fixed rates · Keeps your first mortgage in place · Possible tax deductions · Up to 90% loan-to-value for qualified borrowers · Competitive rates · No. A Home Equity Line of Credit (HELOC) lets you access money as you need it—now and in the future. Apply Online Let Us Contact You. Low cost. Because HELOCs are secured, they typically have lower rates than personal loans or credit cards. In addition, there are no application fees or. Additional HELOC Benefits ; Enjoy financial flexibility. · Rates may often be lower than other forms of borrowing like credit cards or personal loans ; Lock in a. Home Equity Lines of Credit (HELOC) are variable-rate lines. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are.

HELOC Conversion Loans - Lock in Low Rate and Fix Your Payment You can convert the balance of your HELOC and lock it into a fixed rate for a specific length. Discover how your home's equity can work for you! Pay no closing costs1 for lines of credit up to $,, receive rates as low as % APR2 and receive. One advantage of a HELOC is that you can borrow and repay repeatedly for several years without additional paperwork. Interest rates are typically lower than. Home equity lines of credit often have low interest rates and a flexible borrowing structure, making them a beneficial loan for home improvement costs. You could enjoy a low variable introductory rate on a home equity line of credit. Now: % Special Introductory variable APR. As of 07/27/, Prime Rate is % and the APR is %. Maximum APR that will apply during the life of this line is %; Minimum APR is %. The. Now your home's market value is a good bit higher than what you owe on your loan. That means you have equity. And you can use it as collateral to obtain a low-. With competitive rates, low fees, and a quick funding process, you'll save time and money with an Advantis home equity line of credit (HELOC). With a home equity line of credit (HELOC), the lender provides a credit line at a variable or floating interest rate that you can draw on as needed, up to an. And for a limited time, you can get even more out of your home's value with a % discount* on the already low rate of any new America First home equity loan. You can apply for a home equity line of credit up to 85% of your home's equity, or the difference between what's currently owed on their home loan and the. Home equity lines of credit and home equity loans with no closing costs or hidden fees. Review current home equity rates and see how you can borrow against. Closing costs for a HELOC may amount to 2% to 5% of the total loan amount. You should also budget for any ongoing yearly fees. Many lenders don't charge closing. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. A HELOC is a variable-rate line of credit that lets you borrow funds for a set period and repay them later. What is a HELOC? Home equity loans let you. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Home Equity Loans offer convenient, low-cost financing for home improvements. A Home Equity Line of Credit (HELOC) can be used to finance virtually anything. HELOC A. % 5-Year Fixed Rate. Prime + % Variable Rate. $50/Waived Annual Fee Prime Variable Index Waived Closing Cost Up to % LTV/CLTV Advance. A Home Equity Line of Credit gives instant access to a line of credit and low rates, no closing costs options,1 and potential tax savings2. Apply. Home Equity Line of Credit (HELOC) · No closing costs · Variable rate · Pay interest only on the amount you actually use · As you pay towards the principal balance.

Best Neobank Savings Account

It offers mobile-first checking accounts, savings accounts, and a Chime Visa Debit Card. Account holders also enjoy a competitive APY and no overdraft fees. Another considerable feature that neobanks like Revolut and N26 (which we'll dive into shortly) offer is that they offer multi-currency accounts and the best. Top 15 neobanks and mobile banks in the US - United States ; 4. Acorns ; 5. Primis Bank ; 6. Quontic Bank ; 7. Revolut. Chime is a completely digital bank that forgoes the fees most traditional banks charge. The neobank offers simple spending and savings accounts with Visa debit. OnJuno is a cross-border neobank platform that aims to give users across the world a high yield account to grow their savings. Open. Open. Bank. Lend. Pay. Best of , Best Online Banks. smartasset: out of 5 stars. US News and Underwriting fee savings valued at $1, 1National Rates and Rate Caps. 2. For example, neobanks don't need to have a bank license under federal or state regulations. However, to ensure deposits are insured by the Federal Deposit. FDIC-insured Deposits** · 1. Meow FAB Score: 27 (up 5 from May) – HQ: NYC · 2. Mayfair FAB Score = 13 (down 1 since May) Founded: · 3. Baselane FAB Score: Digital and convenient banking services for bill payments, prepaid cards, money transfers, and savings account. Highly personalised, convenient, flexible and. It offers mobile-first checking accounts, savings accounts, and a Chime Visa Debit Card. Account holders also enjoy a competitive APY and no overdraft fees. Another considerable feature that neobanks like Revolut and N26 (which we'll dive into shortly) offer is that they offer multi-currency accounts and the best. Top 15 neobanks and mobile banks in the US - United States ; 4. Acorns ; 5. Primis Bank ; 6. Quontic Bank ; 7. Revolut. Chime is a completely digital bank that forgoes the fees most traditional banks charge. The neobank offers simple spending and savings accounts with Visa debit. OnJuno is a cross-border neobank platform that aims to give users across the world a high yield account to grow their savings. Open. Open. Bank. Lend. Pay. Best of , Best Online Banks. smartasset: out of 5 stars. US News and Underwriting fee savings valued at $1, 1National Rates and Rate Caps. 2. For example, neobanks don't need to have a bank license under federal or state regulations. However, to ensure deposits are insured by the Federal Deposit. FDIC-insured Deposits** · 1. Meow FAB Score: 27 (up 5 from May) – HQ: NYC · 2. Mayfair FAB Score = 13 (down 1 since May) Founded: · 3. Baselane FAB Score: Digital and convenient banking services for bill payments, prepaid cards, money transfers, and savings account. Highly personalised, convenient, flexible and.

Like most other banks, Starling Bank offers access to both current and business accounts. Furthermore, it also provides overdrafts and loans, not to mention. Low Fees: Neobanks often have lower fees than traditional banks. They may offer free accounts and reduced charges for transactions. User-. Chime offers a full suite of retail banking services, including checking and savings accounts, debit and credit cards, instant payments, and an expansive ATM. Savings goals? Check. Life just got a lot better. Meet your Smart account. A tap is all it takes. Check balance, make payments, transfer money — every action. All of the savings. None of the bull. · Track your goals to reach them fasterPersonalize up to 10 accounts with custom names, icons, and amounts for each goal. Salary Transfer · Arab Bank Transfers · Pay Later · Digital Account · Reflect Card · Savings Account · Virtual Card. Feature. Top Up · Credit Card · IBAN. Common known neobanks are Revolut, Wise, N26, Monzo, Paysera, Monese and many more. This article will dive into what neobanks are, how they work and whether you. savings accounts that are good for your wallet and the planet's future. Get Put your money to work with our high-yield savings account. Terms and. Transform the way you manage your money with Starling Bank. Enjoy personal and business banking online and at your fingertips, always. Apply in minutes. Savings accounts, a range of mortgages & business loans, you'll find it all with Atom bank. App-based and designed to be hassle-free. Online savings accounts are a convenient way to establish and manage a savings account, with transactions handled on the internet rather than at a. Koho — Best Overall Free Virtual Account · Neo Financial — Best Suite of Financial Services · Tangerine — Best to Access Mortgages and Loans. Automatically increase your savings. Online banking is simple and easy. Chime is a financial technology firm, not a bank. The Bancorp Bank and Stride Bank, N.A. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. Access up to $10, in savings on best-in-class business tools. Deposit account services provided by Middlesex Federal Savings, F.A., Member FDIC. Financial software and services to fuel your growth. Brex lets you send free ACH and wires worldwide, get higher card limits, earn money-saving rewards, and. Savings accounts, a range of mortgages & business loans, you'll find it all with Atom bank. App-based and designed to be hassle-free. Earn up to 3% back on gas and groceries and up to 1% on everything else as your deposit balance increases¹ · No monthly fees · No minimum balances · Free everyday. The first high-performance checking and savings accounts engineered to reverse the climate crisis. Best Green Banking for Eco-Friendly Checking and. Neobanks came into focus following the financial crisis and quickly stood out for their flexibility and higher saving account interest rates compared to.

Assets Based Loans

Asset-based lending is loaning money in an agreement that is secured by collateral. An asset-based loan can be secured by equipment, inventory, accounts. Put your business assets to work for you with Asset-Based Lending. Loans are secured by assets such as accounts receivable, inventory, machinery. An asset-based loan or mortgage allows you to utilize the assets you have already invested in to secure the cash you need now. Payment Frequency* Asset-based loans give small businesses access to working capital through an agreement that's secured by business collateral such as. Asset-based financing provides working capital as a structured revolving line of credit based on a percentage of the value of the company's assets. Our asset based loans allow businesses to maximize capital that can be used for acquisitions, growth plans, debt restructuring and managing cash flow. Asset-Based Lending. Our financing solutions let you leverage the value of your assets to grow, balance, or reshape your business. ABL Loan Structures. Asset-based borrowing can be structured as a revolving line of credit, a term loan or a combination. Revolving line of credit – You're able. Asset based lending, or ABL, is a type of loan that is secured by various types of collateral — and it offers significant advantages to your company. Asset-based lending is loaning money in an agreement that is secured by collateral. An asset-based loan can be secured by equipment, inventory, accounts. Put your business assets to work for you with Asset-Based Lending. Loans are secured by assets such as accounts receivable, inventory, machinery. An asset-based loan or mortgage allows you to utilize the assets you have already invested in to secure the cash you need now. Payment Frequency* Asset-based loans give small businesses access to working capital through an agreement that's secured by business collateral such as. Asset-based financing provides working capital as a structured revolving line of credit based on a percentage of the value of the company's assets. Our asset based loans allow businesses to maximize capital that can be used for acquisitions, growth plans, debt restructuring and managing cash flow. Asset-Based Lending. Our financing solutions let you leverage the value of your assets to grow, balance, or reshape your business. ABL Loan Structures. Asset-based borrowing can be structured as a revolving line of credit, a term loan or a combination. Revolving line of credit – You're able. Asset based lending, or ABL, is a type of loan that is secured by various types of collateral — and it offers significant advantages to your company.

It allows you to secure a loan based on the value of your business assets. With our asset-based lending program, you can borrow up to 90% of accounts receivable. Bank of America Business Capital. If your company is seeking financing solutions of $5 million or more, you can benefit from the flexibility and versatility of. We can provide your small business with flexible working capital financing solutions, including both accounts receivable and inventory. Webster Business Credit provides asset-based loans to help you access the liquidity locked in your assets. Click today to learn more from a leader in. Our asset-based lending helps your company get working capital to fund operations and growth, even with limited credit or a challenged credit history. ABL lenders provide credit at different points in the working capital cycle with advances being paid down with cash receipts. An ABL lender focuses primarily on the value of your business's assets, which are used as collateral to secure financing. Often considered the next step up from. Asset Based Lending leverages your assets as collateral to secure business loans. Your cash flow, accounts receivable and inventory and fixed assets are all. Asset-based lending is a form of business financing that's secured by collateral. Collateral is any asset a business owns that is of value and can be used. Help support your cash flow or seasonal needs as your business grows. Benefit from customized Asset-Based Lending solutions with Citizens Business Bank. Asset based lending solutions from $5 million to $1 billion. Our revolving lines of credit and term loans can be right for companies with asset rich balance. Asset-based lending works just like a revolving loan, which means it's available when you need it, and you can pay it down whenever you choose. Credit lines from First American Bank in IL, WI and FL address cash-flow needs of growing companies. Learn more about our Asset-Based Loan options. In asset-based lending, the loan is secured by the assets of the borrower. Examples of assets that can be used to secure a loan include accounts receivable. Asset-based loans are a popular financing option for businesses that require cash flow to fund their operations or expand their business. Asset Based Lending is a trusted hard money lender for real estate investors & small business owners. See how you can get direct private loans near you. What is Asset-based lending? Asset-based lending is a business financing method that uses an asset owned by a business as security against a business loan. The. Compared to unsecured loans, asset-based loans have much lower rates. In general, asset-based loan rates range from % to 15%. The financing can be. Asset-based lending Asset-based lending is any kind of lending secured by an asset. This means, if the loan is not repaid, the asset is taken. In this sense. Asset Based Lending (ABL) provides fast-growing or highly leveraged companies with working capital. RBC has been active in the North American ABL market.

What Is The Mortgage Rate For A 15 Year Loan

Is interest higher on a year mortgage? ; Down Payment. $85, (20%). $85, (20%) ; Interest Rate. %. % ; First Monthly Payment · Principal. $1, When you are deciding how long a loan to take out when you buy or refinance a home, it's important to understand the differences in the total cost and payments. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed. Today's current year, fixed-rate mortgage rates* ; year fixed, %, %. (1) Your loan is one of the following fixed-rate mortgage loan products: Homebuyers Choice, Military Choice, or and year Jumbo Fixed loans (collectively. Save on interest with a fixed, lower rate. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Introduction to Year Fixed Mortgages ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. In addition, today's national year refinance interest rate is %, down 8 basis points over the last week. For now, the consensus is that mortgage rates. The average APR on a year fixed-rate mortgage rose 2 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) remained at Is interest higher on a year mortgage? ; Down Payment. $85, (20%). $85, (20%) ; Interest Rate. %. % ; First Monthly Payment · Principal. $1, When you are deciding how long a loan to take out when you buy or refinance a home, it's important to understand the differences in the total cost and payments. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed. Today's current year, fixed-rate mortgage rates* ; year fixed, %, %. (1) Your loan is one of the following fixed-rate mortgage loan products: Homebuyers Choice, Military Choice, or and year Jumbo Fixed loans (collectively. Save on interest with a fixed, lower rate. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Introduction to Year Fixed Mortgages ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. In addition, today's national year refinance interest rate is %, down 8 basis points over the last week. For now, the consensus is that mortgage rates. The average APR on a year fixed-rate mortgage rose 2 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) remained at

Loan term: Loan term is the length of time over which you repay your mortgage. Shorter-term mortgages, like 15 year terms, often come with lower interest rates. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Year FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady A mortgage interest rate is the percentage you pay to borrow money for a home loan. A year mortgage is a fixed-rate home loan with a repayment period of half the time compared to the 'traditional' year mortgage. A year fixed-rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. What is a 15 year fixed rate mortgage? A 15 year fixed year mortgage is a loan that will be completely paid off in 15 years assuming all. Save on interest with a fixed, lower rate. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Year Fixed Rate Mortgage Average in the United States (MORTGAGE15US) ; ; ; ; ; Lenders are exposed to fewer years of risk when they give you a year Fixed Mortgage. This allows them to charge a lower interest rate. Also, since you're. Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. Additionally, the current national average year fixed mortgage rate decreased 1 basis point from % to %. The current national average 5-year ARM. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. A year fixed mortgage is a loan with a repayment period of 15 years and an interest rate that remains the same throughout the life of the loan. For a year mortgage, your bank will use a year mortgage rates calculator to figure out your monthly payments. It divides your interest rate by 12 to get. The current average rate for a year fixed mortgage is %. · Mortgage Rate Trends · What determines mortgage rates for year loans? · What's the difference. As of August 29, , the average year refinance mortgage APR is %. We're sorry, there was a problem loading search results. Advertising Disclosure. Compare mortgage rates when you buy a home or refinance your loan. Save Showing: Purchase, Good (), year fixed, Single family home, Primary. Today's Rate on a Year Fixed Mortgage Is % and APR % · View Advertising Loan Disclosures. The interest rate is lower than a year fixed. A year fixed mortgage is a home loan that has a set interest rate for 15 years. This means your mortgage rate won't change, regardless of how the overall.